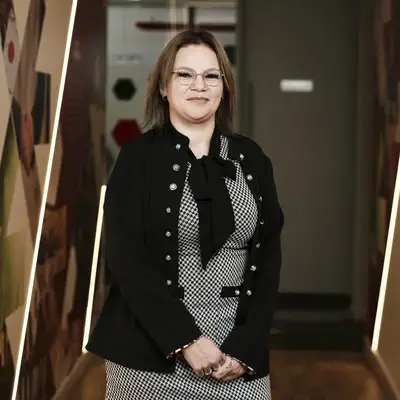

Working in conjunction with the commercial litigation and private client teams, Smith Partnership's practice handles private client, professional negligence and will and estate claims. Heading up the practice, Victoria Townsend is a key contact for advising on will disputes, proprietary estoppel and family trust issues. Townsend is an accredited member of the ACTAPS and has been lauded by clients for her ‘professional integrity, patience, and judgement’.

‘My solicitor was exceptional and could not have been more helpful, kind and courteous to me and my wife.’

‘In my experience, what makes this practice unique is the quality of thinking and calm authority that underpins every stage of their work. The team at Smith Partnership, and particularly the Contentious Trusts and Probate team, have a rare ability to manage sensitive and high-stakes matters with both legal precision and a human touch.'