How We Help You

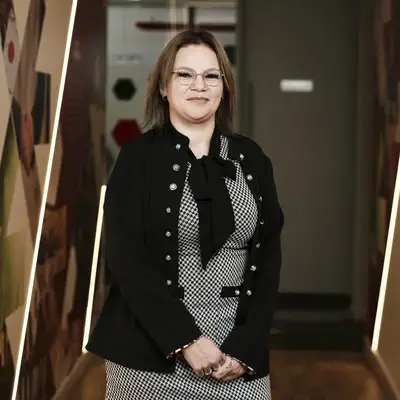

At Smith Partnership in Leicester, we offer a comprehensive range of services to guide you through all aspects of wills and probate. Whether you're planning for the future of your children and family, managing the estate of a loved one, navigating complex inheritance tax issues or need help with setting up a trust, our experienced team provides expert, tailored legal advice. We offer a transparent approach to the cost of our services so that you know what you will pay and take, jargon-free approach to ensure that your affairs are handled with care and with you at the heart of our approach every step of the way.

We offer a choice of ways to instruct us in person at our office or using video conferencing for your convenience. We recognise above all that understanding your circumstances and getting to know you will result in the best possible advice and service.

· Will writing and estate planning tailored to your needs

· Trust creation and administration

· Estate administration, including Grant of Probate advice

· Inheritance Tax planning and lifetime gift strategies

· Expert guidance on trusts and Lasting Powers of Attorney (LPA)

· Support with contentious probate, inheritance disputes, and contesting wills